Orange Juice

Your

quarterly

vitamin.

A New Entrant in the Streaming Wars

Written on 01/29/20 11:44 AM

With the success in recent years of streaming content providers such as Netflix, Amazon Prime Video, and Hulu, major tech and content players have entered the scene. In late 2019, Disney and Apple launched their own streaming products. NBCUniversal (NBCU)—the parent company of Comcast and the NBC family of networks—is the next conglomerate to unveil a streaming service: Peacock.

With the success in recent years of streaming content providers such as Netflix, Amazon Prime Video, and Hulu, major tech and content players have entered the scene. In late 2019, Disney and Apple launched their own streaming products. NBCUniversal (NBCU)—the parent company of Comcast and the NBC family of networks—is the next conglomerate to unveil a streaming service: Peacock.

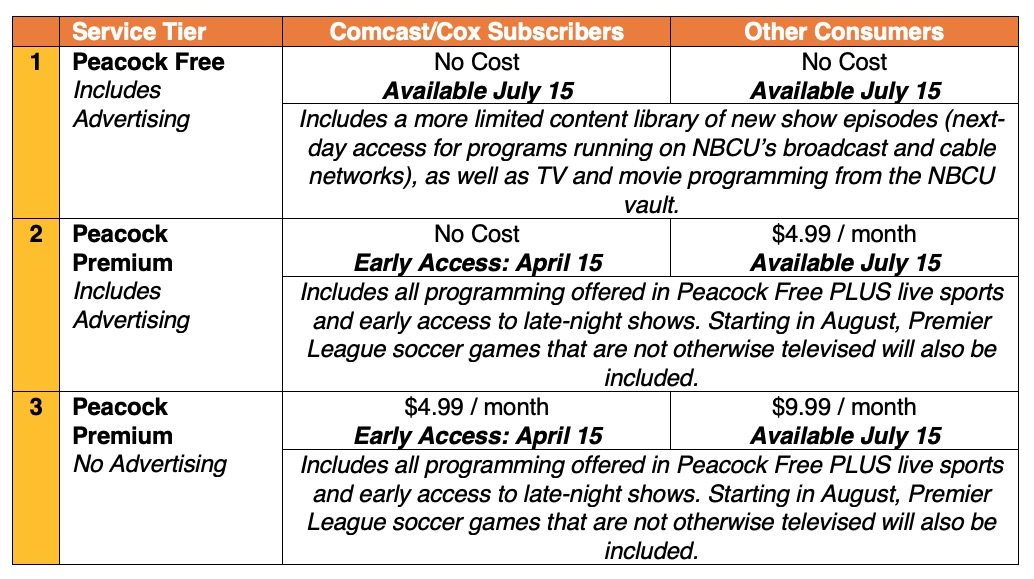

According to The Verge, NBCU will be offering consumers three tiers of service with different offerings and price points depending on whether a consumer is a Comcast / Cox cable customer:

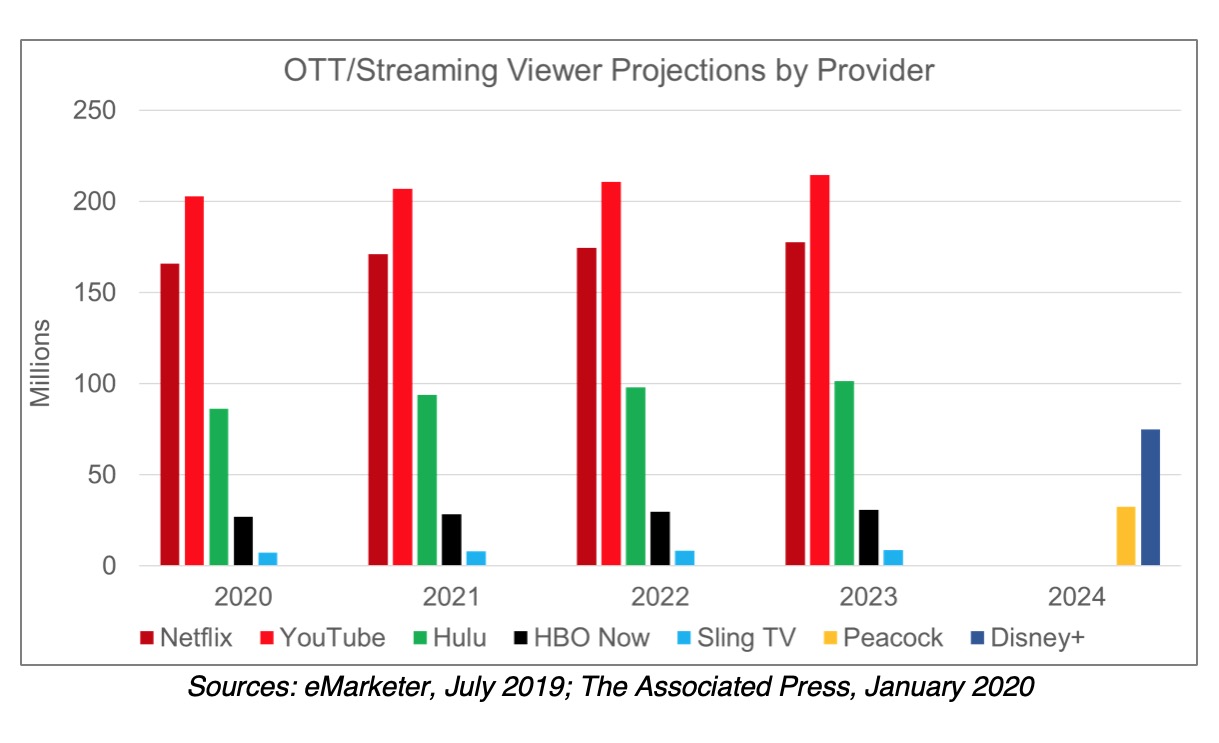

Subscriber Projections. NBCU is taken a conservative approach in estimating, and possibly in growing, its subscriber counts. As shared with the Associated Press, NBCU is projecting 30 to 35 million Peacock accounts by 2024. The chart below shows how Peacock would stack up if it meets projections. (Please note that 2024 data for Netflix, YouTube TV, Hulu, HBO NOW, and Sling TV are not available. Viewer projections for Peacock and Disney+ prior to 2024 are not readily available at this time.)

Peacock for Advertisers. The ad-supported tiers will have fewer and/or shorter commercial pods, totaling less than five minutes per hour. This is far less than commercial-to-programming ratio on linear TV (11 minutes on average and 17-18 minutes for NBCU networks, specifically) or on Hulu (9 minutes). Having fewer commercials will be beneficial to both viewers and brands thanks to the reduced advertising clutter. NBCU will also carefully plan the ad load so that viewers will not see the same ad more than once in a 30-minute block; frequency capping issues have historically plagued ad-supported streaming services, on demand, and other digital video players when not well managed.

From CNBC reporting, here are the planned ad types on Peacock:

| Pause ads | which would take over the whole screen of your device when a viewer pauses a show with messaging around “taking a break” |

|---|---|

| Binge ads | will trigger when a consumer watches three episodes of a show, and a sponsor will bring a fourth episode ad-free |

| Shoppable TV | ads let viewers buy products that are related to the shows they’re watching. |

| Prime Pods | are single, 60-second ad spots |

| Engagement ads | will attempt to get consumers to interact with advertisements using trivia questions or product galleries |

| Trending ads | will show advertisements that are based on certain topics |

| Solo ads | will limit advertising to a single ad within an episode of a show |

| Curator ads | will curate collections of NBCUniversal titles based on moods, genres, events or other themes, with the opportunity for brands to sponsor those collections |

| Explore ads | will show a collection of content related to what a viewer was watching while they’re paused, offering an option for a viewer to get a discount sent to their phone if they’re interested in the product being shown. |

Peacock already has national advertisers (Target, State Farm Insurance, Unilever) on board for a co-promotional push to generate interest and sign-ups.

No clear word as of yet if ad buys will be possible at the local level and/or through programmatic buying. RPM will keep our regional and local clients apprised of any developments. RPM currently includes NBCU networks and apps in its CTV/OTT buys for clients. This includes the following live sports and the following channels and apps.

- Sources:

- thetimestribune.com/cnhi_network/nbc-hopes-free-makes-peacock-stand-out-in-streaming-era/article_3519109c-3d45-11ea-bf5b-77b2fa9bbb40.html

- theverge.com/2020/1/16/21068607/nbc-peacock-streaming-service-price-launch-date-ads-universal-comcast-office-harry-potter

- cnbc.com/2020/01/16/nbcus-peacock-will-have-no-more-than-five-minutes-of-ads-per-hour.html

- adexchanger.com/platforms/peacock-unveils-ad-platform-with-performance-style-ads/

- deadline.com/2020/01/nbcuniversal-expects-2-5b-in-peacock-revenue-break-even-by-2024-1202833243/